Claims Process in Zelis Payments

How Claims are Submitted and Processed through Zelis

The claims process in Zelis Payments follows a structured approach to ensure efficiency, accuracy, and timely resolution. This section will explore the entire process from submission to resolution, providing insights into how claims are managed.

Claim Submission

The claims process starts after provider or healthcare facility submits claim to Zelis Payments for reimbursement. Claims submitted in various ways depending on the specific requirements of the healthcare provider and the payer. Common submission methods include:

- Electronic Data Interchange (EDI): EDI is shared method for submitting claims to Zelis. It allows providers to send claims electronically and ensuring fast processing and minimizing manual errors.

- Paper Claims: In some cases providers need to submit paper claims. Zelis accepts these by standard mail. The method is slower and may result in delays.

- Web Portal: Providers submit claims directly by the Zelis web portal, providing an easy to use interface to track and manage claim submissions.

Claim Validation and Verification

When claim is submitted Zelis Payments performs initial validation process. The step ensures the claim contains all necessary information and meets the payer’s requirements. During the process several key checks are performed:

- Eligibility Verification: Zelis then verifies the patient’s program coverage for the particular treatment or service delivered. It means confirming insurance information and ensuring the patient is on the insurance plan during the service delivery.

- Claim Formatting: To perhaps further ensure that the claim meets these requirements, Zelis makes certain the correct formatting is done well, including HIPAA formats.

- Data Accuracy: Critical step in claim validation is verifying the accuracy of the provided data like patient information, service codes and billing details.

Claim Adjudication

After claim passes the validation phase it moves into the adjudication process. Here the claim is reviewed against the payer’s policies to determine it will be approved or denied. During adjudication the following factors are considered:

- Medical Necessity: Therefore, the services are billed by Zelis are proven to be medically required depending on the patient’s diagnosis and treatment plan.

- Contractual Rates: It means all the claims are evaluated with reference to the agreed upon rates between the provider and the payer.

- Payment Rules: The claim is evaluated to determine if it meets the payer’s guidelines. It may include limits on certain services or additional documentation requirements.

Approval or Denial Notification

Once adjudication is complete the claim is approved or denied. Zelis provides detailed notifications to both the provider and the payer and It include:

- Explanation of Benefits (EOB): If the claim is approved EOB is generated detailing the reimbursement amount any patient responsibility and any adjustments made.

- Denial Notices: In cases the claim is denied Zelis sends a denial notice to the provider. It outlines the reasons for the denial and any additional steps needed for resubmission or appeal.

Claim Payment or Reimbursement

After approval the claim proceeds to payment. Zelis ensures the correct reimbursement amount is paid to the healthcare provider. Payments are typically processed through:

- Electronic Funds Transfer (EFT): Claims are mostly paid through EFT Most claims are processed through Payments. They did give fast and secure ways of transferring the funds right to the provider’s bank account.

- Paper Checks: Sometimes particularly when it is an older system or EFT cannot be made payments are done using check papers.

Handling Disputes and Appeals

If provider disagrees with the claim’s decision (whether denied or partially paid), they initiate an appeal. Zelis provides structured appeals process and allows providers to submit additional information or clarifications. It could influence the outcome. The dispute is reviewed by the payer and decision is made accordingly.

How Providers Submit Claims to the Payer (Insurance Company)

The step where claims are forwarded to the payer, usually the insurance company is an important aspect of health care since it creates credibility and guarantees service deliverers their payment for services offered. Zelis Payments, as intermediary plays significant role in simplifying and streamlining the process. Here is detailed overview of how healthcare providers submit claims to the payer by Zelis:

1. Claim Preparation and Documentation

Before submitting claims to the payer providers must ensure the all necessary documentation is prepared. The step involves gathering detailed information about the patient’s visit it including:

- Patient Information: Social security number, policy number, phone number and other specific information.

- Service Codes: In providing prescriptions and diagnoses the complete forms of the medical codes comprising CPT, ICD-10 and HCPCS with corresponding to the treatment

- Billing Details: Procedures codes, modifiers and any adjustments which are itemized are very important when it comes to billing.

- Authorization and Pre Approvals: If required providers must include any pre authorization or pre certification numbers to ensure the services are covered by the payer.

2. Electronic Claims Submission

Some practices adopt an automated capture of the data while other providers input the claim data into their practice management software or the electronic health record (EHR) system. The benefits of using EDI include:

- Speed: EDI submissions are faster than paper claims reducing processing time.

- Accuracy: EDI helps minimize errors by using standardized formats and reduce the risk of incorrect coding or missing information.

- Real Time Tracking: Providers track the status of claims in real time knowing the payer received and processed the claim.

Steps for Electronic Claim Submission:

- Providers enter claim data into their practice management software or electronic health record (EHR) system.

- The software formats the claim data into an electronic version (usually ANSI X12 format).

- The claim is transmitted to Zelis Payments, and acts as intermediary and forwards it to the payer.

- Providers monitor the claim status through their practice management system or Zelis web portal.

3. Paper Claims Submission

Electronic claims submission is the most efficient and some providers may still need to submit claims via paper. Especially in situations where EDI is not supported or the payer requires paper submissions. In these cases the provider must ensure the paper claim is complete and accurate.

Steps for Paper Claim Submission:

- Providers manually complete the claim form (typically a CMS-1500 form for professional claims or UB-04 for institutional claims).

- The completed form is mailed to the payer’s claims department, frequently with supporting documentation like medical records or invoices.

- Paper claims allow enough time to process them and also contain certain inherent errors which are not found in electronic claims.

4. Web Portal Submission

Many payers including insurance companies offer dedicated web portals and allow healthcare providers to submit claims directly online. The method provides easy to use interface. With the option to track claim statuses and receive real time updates.

Steps for Web Portal Submission:

- Providers log in to the payer’s web portal using secure credentials.

- Claims data is entered or uploaded in the required format. To attach supporting documents like diagnostic tests or treatment plans.

- The claim is submitted electronically and providers typically receive immediate acknowledgment of submission.

- Providers check the status of the claim and make corrections if necessary.

5. Claim Review and Error Checking

Before submission it is essential for providers to carefully review their claims for errors. Incorrect information lead to delays in processing or denials. Common errors to check for include:

- Incorrect or missing codes: Misuse of medical codes or failure to include necessary codes result in claim rejection.

- Eligibility issues: Claims should submitted if the patient is eligible under the insurance plan for the services rendered.

- Duplicate submissions: Submitting the same claim more than once cause confusion and delays.

6. Working with Zelis Payments for Efficient Submission

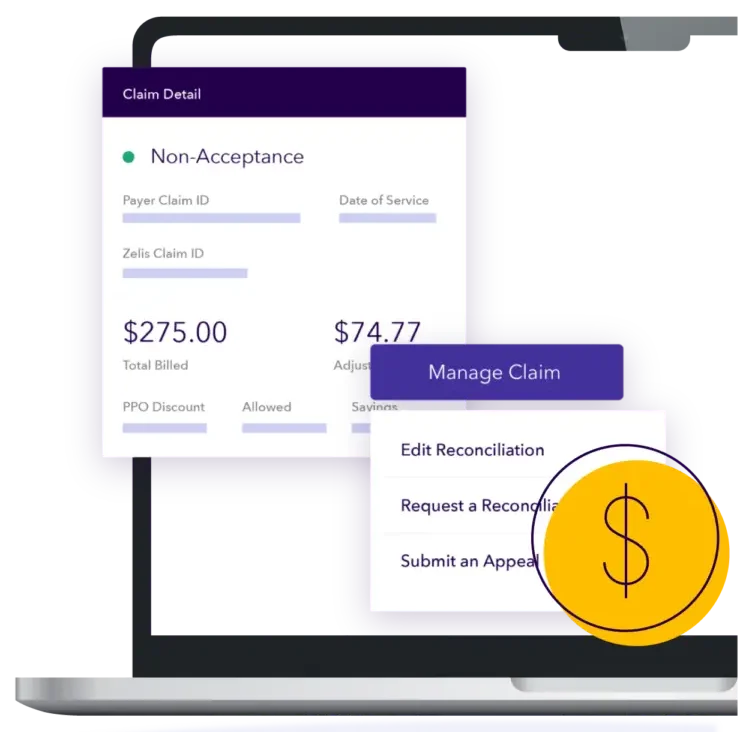

Zelis Payments provides platform for providers to submit claims efficiently, track claim statuses and resolve any issues. As an intermediary Zelis plays key role in ensuring the claims are routed correctly to the payer and providers receive feedback promptly. Providers use the following features on the Zelis platform:

- Claim Tracking: Providers track the real time status of claims and receive notifications when claims are processed or if any errors need to be addressed.

- Claims Status Updates: Zelis provides updates regarding claims approval, payment or if additional information is needed.

- Error Alerts and Corrections: If any errors are detected during the submission process, Zelis alerts the provider allowing them to make corrections before submitting the claim to the payer.

How Users Track the Status of Claims, Real-Time Updates and How to Resolve Issues

Tracking claims and receiving timely updates are critical components of the claims management process.It ensuring the healthcare providers and stakeholders stay informed and address any issues promptly. Zelis Payments offers robust features and allow users to track the status of claims and receive real time updates and resolve any issues and arise during the claims process. Here is detailed guide on how users effectively use these feature:

1. Claim Status Tracking

Zelis Payments provides healthcare providers with user friendly interface to track the status of claims submitted to payers. From the Zelis platform users gain insight into each claim’s progress and take necessary actions if there are any issues.

Key Features for Tracking Claims

- Claim History: Providers view detailed history of claims, including submission dates, status updates and payment information.

- Status Indicators: Claims are marked with clear status indicators like Pending, Under Review, Paid, or Denied. Making it easy to assess where each claim stands in the process.

- Claim Summary: Each claim entry includes the summary with key details. Like patient’s information, procedure codes, billed amounts and payer’s responses.

2. Real Time Updates and Notifications

Zelis Payments offers real-time updates and allowing providers to stay informed about the status of their claims throughout the process. These updates ensure the users are aware of any changes or developments as they happen, preventing delays and enabling proactive management of claims.

How Real-Time Updates Work:

- Email Alerts: Providers receive email notifications and the status of claim changes. For example, if claim is approved or payment is issued, email will be sent to inform the provider.

- SMS Notifications: In addition to email alerts, some systems may send SMS notifications for critical updates, offering quicker way for providers to stay informed.

- Web Portal Alerts: The Zelis web portal offers instant alerts about claims the need attention. These alerts highlight issues like missing information, coding errors or requests for additional documentation.

3. Claim Status Categories

Understanding the status of each claim is essential for users to take timely action. Here are some of the common claim status categories available from Zelis Payments:

- Pending: The claim is awaiting processing by the payer. Providers track how long it and the status and take action if delays occur.

- Under Review: The payer is actively reviewing the claim. The status indicates the the payer might need additional documentation or clarification.

- Paid: The payer approved the claim and issued payment. Providers review the payment details, including the amount reimbursed and any adjustments made.

- Denied: The claim rejected by the payer. And status requires providers to review the reasons for the denial and take corrective actions.

- Adjusted: The claim adjusted based on payer feedback. The might happen when there are discrepancies between the billed amount and the amount covered by the insurance.

4. Resolving Issues with Claims

When issues arise during the claims process, providers must act quickly to resolve them. Zelis Payments offers several tools to help users address problems efficiently:

Common Claim Issues and How to Resolve Them:

- Claim Denial: A claim may be denied for various reasons like incorrect coding, insufficient documentation or lack of patient eligibility. Providers view the denial reason through the Zelis portal and take corrective actions like submitting additional documentation or correcting the coding errors.

- How to Resolve: Review the denial reason, update the claim with the correct information and resubmit it to the payer.

- Underpayment: Sometimes the payer may pay less than expected due to errors in billing or incomplete coverage details.

- How to Resolve: Compare the payment details with the original claim and the payer’s contract terms. If there is an underpayment, providers submit an appeal to the payer, providing necessary documentation to support their case.

- Missing or Incorrect Information: Claims may be flagged for missing or incorrect details like wrong codes or outdated patient information.

- How to Resolve: Use the platform’s tracking features to identify the specific missing or incorrect details, update the claim accordingly and resubmit it.

- Payment Delays: Claims may be delayed if there are issues with the payer’s processing systems or if additional information is required.

- How to Resolve: Contact the payer directly to inquire about the delay, or check the claim’s status and any pending requests through the Zelis portal.

- Appeals Process: If a claim is denied or underpaid, providers appeal the decision to the payer. Zelis offers tools to track the progress of appeals and resubmit any additional documentation if required.

- How to Resolve: Follow the payer’s guidelines for submitting an appeal and provide all supporting documentation to ensure the claim is reconsidered.

Read Also: What Are The Best Claims Management Practices?

5. Claim Payment Tracking and Reconciliation

Once claim is paid, providers track the payment through the Zelis system. Zelis Payments helps streamline payment reconciliation by providing clear details about each payment made by the payer.

Payment Reconciliation Features:

- Payment Report: Providers view detailed payment reports the include the amount paid, adjustments and any patient responsibility.

- Payment Remittance Advice (ERA): Providers receive Electronic Remittance Advices and offers detailed explanations of payments and adjustments made on their claims.

- Discrepancy Management: If the payment amount differs from the expected amount, providers use the Zelis platform to investigate and address discrepancies.

6. Tracking Multiple Claims Simultaneously

For healthcare organizations handling large volume of claims, Zelis Payments allows users to track multiple claims at once. This functionality includes:

- Batch Processing: Providers view and track claims in batches, making it easier to identify trends, track multiple claims at once and manage follow-ups.

- Bulk Updates: The system allows for bulk updating of claim statuses, saving time for providers and ensuring the all claims are kept up to date.