Zelis Payments enrollment is a fundamental step healthcare providers, payers, and other participants work through to join Zelis’ expansive payment network. It is a crucial stage of advancing healthcare compensation efficiency and shifting from dated paper based transactions to more efficient digital payment methods. Through enrolment providers have access to a centralized platform which streamlines claims processing, payment management and notifications. Adoption of the system allows hospitals to lower administrative burdens. It reduces costs and speeds cash flow to improve reimbursements.

Hospitals, clinics, laboratories, insurance companies, and third-party administrators are Zelis Payments stakeholders. Enrollment is flexible. You make a direct deposit (ACH) and fast bank transfers, virtual credit cards for immediate fund access. Or traditional paper checks if you are not ready to go all digital yet.

How to Enroll in Zelis Payments?

The registration process at Zelis Payments is quite simple and this seeks to make it easier for healthcare providers, payers, and others to make the transition to the next level of digital payments infrastructure. Below is a detailed step-by-step guide on how to successfully enroll in Zelis Payments:

Step 1: Initial Contact & Invitation

- Healthcare Providers and Payers: Zelis may email you the invitation or your provider’s insurance plan inviting you to participate in their payment system.

- Self-Initiated Enrollment: Often you can find out about enrollment by visiting the Zelis Payments official website and going to the enrollment part.

Step 2: Choose Your Payment Option

Zelis offers multiple payment methods to cater to diverse needs:

- Direct Deposit (ACH): Ideal for fast, secure payments directly into your bank account.

- Virtual Credit Card: Provides immediate fund access with no delays in check clearing.

- Paper Checks: For those who prefer traditional payment methods.

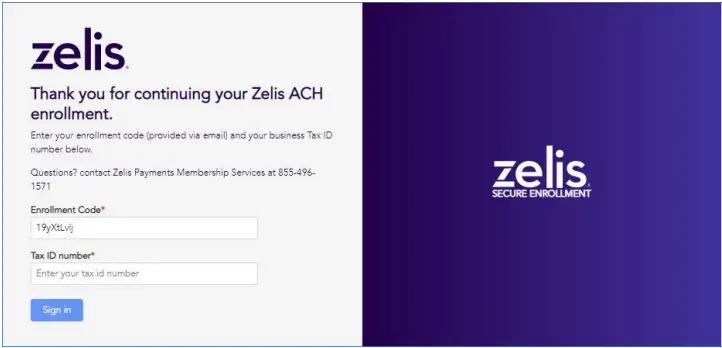

Step 3: Register Online

- Access the Zelis Enrollment Portal:

- Visit the official Zelis Payments enrollment page.

- It include clicking on the “Get Started” or “Enroll Now” button.

- Provide Essential Information:

- Tax Identification Number (TIN): Necessary for identification purposes, as well as for the completion of the related payment transactions.

- National Provider Identifier (NPI): To see that a correct identification is made.

- Bank Account Details: For ACH or direct deposit options.

- Contact Information: Ensure your email and phone number are accurate for communication.

Step 4: Verification Process

- Zelis Team Review:

- Zelis verifies all submitted details, ensuring compliance with security and regulatory standards.

- Follow-Up Communication:

- You may receive emails requesting additional documentation for validation or clarifications.

- Approval Notification:

- If you have been given the green light to use the application, you will receive an email confirming the login details and access information.

Step 5: Configure Payment Preferences

- Log into your newly activated Zelis Payments account.

- After reaching the online platform’s webpage, go to the “Settings” tab and select the most suitable payment option.

- Configure notifications for real-time payment alerts and claim updates.

Step 6: Final Confirmation & Activation

- After configuring your account, Zelis will send a final activation notice confirming that your payment preferences are live.

- Providers can now start receiving payments through their selected method.

Step 7: Access Ongoing Support

- Zelis Customer Support: Available for any enrollment-related questions via:

- Hotline: For immediate assistance.

- Email Support: For non-urgent queries or documentation issues.

- Help Center: A comprehensive FAQ section and step-by-step tutorials.

Benefits of Following This Enrollment Process

- Quick Setup: Streamlined enrollment saves time compared to manual paperwork.

- Customizable Payment Options: Tailor payment methods based on your operational needs.

- Secure Data Handling: Zelis ensures all information is encrypted and meets compliance standards.

- Efficient Reimbursement: The payment cycles are speeded up for the improvement of cash flow and the minimization of administrative work load.

Zelis Payments enrolls participants in changing traditional healthcare reimbursement methods into a smooth digital experience, yielding both provider efficiency and improved patient care. Follow this guide, no matter if you are a provider, a payer, or in between, and will have a seamless transition to the Zelis network.

Challenges & Solutions in Zelis Payments Enrollment

While many advantages are locked in with the Zelis Payments enrollment. However, there are challenges to not registering with Zelis Payments if one does business with these players. Below are some common obstacles and practical solutions to overcome them:

Resistance to Digital Payments

Challenge: But many providers remain uncomfortable with moving away from more familiar, paper based payment methods and are concerned about security.

Solution: Zelis provides specific details on the benefits of moving towards digital payments, including faster reimbursements, better security and lower administrative costs. Providing case studies and testimonials reassure hesitant stakeholders by demonstrating successful transitions.

Complex Enrollment Forms

Challenge: The detailed information needed like TIN, NPI, and bank account is overwhelming and may make process seem like it’s overly long.

Solution: With Zelis, step by step enrollment tutorials and easy to follow online guides make all this simple. Moreover, the system includes tooltips and real-time support to relieve complex sections for users when needed.

Verification Delays

Challenge: Delays in processing due to incomplete or incorrect information during verification.

Solution: Ensure all necessary documentation is accurate and complete before submission. Zelis provides a pre-check list to reduce errors, and their support team is available for assistance if discrepancies arise.

Data Security Concerns

Challenge: Providers may be concerned about the safety of their sensitive financial and patient data.

Solution: Zelis uses advanced encryption and complies with healthcare industry standards like HIPAA and PCI DSS. This guarantees that data is securely handled throughout the process, reducing security-related apprehension.

Integration Challenges with Existing Systems

Challenge: Integrating Zelis Payments with current billing or practice management systems can be complex.

Solution: Zelis offers comprehensive API documentation and technical support to assist with seamless integration, ensuring that providers can efficiently link their systems without disrupting operations.

How to Get Support During Enrollment?

To make the enrollment process smoother, Zelis provides various support channels that cater to different user needs:

Customer Support Hotline

For real-time, immediate assistance during the enrollment process, the hotline is available to resolve urgent issues. This is ideal for providers needing guidance on complex steps or encountering technical difficulties.

Email Support

Users can send detailed queries or documentation-related questions to Zelis’ email support. This method is perfect for non-urgent concerns and allows users to receive comprehensive, written responses that can be referenced later.

Help Center & FAQs

Zelis maintains a robust online Help Center filled with FAQs, tutorials, and user guides. The FAQ section addresses common concerns related to registration, verification, and payment methods, making it a valuable self-service resource.

Dedicated Account Representatives

For larger providers or payers, Zelis assigns dedicated account representatives who offer personalized guidance throughout the enrollment process. This includes help with integrating systems, customizing payment options, and ongoing support.

Webinars and Training Sessions

Zelis frequently hosts live webinars and training sessions designed to walk new users through the enrollment process. These sessions also cover best practices for maximizing the platform’s benefits and resolving common issues.

Any Eligibility Requirements for Enrollment in Zelis Payments

Healthcare providers and payers interested in using Zelis Payments must satisfy certain requirements to ensure a secure and efficient payment process. The Verification will be based on a sustainable and valid Tax Identification Number TIN and the National Provider Identifier NPI. Electronical transfer Providers must provide bank account details to allow easy direct deposit. Participants must also be part of recognized healthcare organisations or networks and follow industry standards (e.g., HIPAA, PCI DSS) in order to safeguard the sensitive data.

In order to show its operational role in payer networks, Billing and Revenue Cycle Management (RCM) companies must demonstrate. Here are key eligibility requirements for healthcare providers, payers and stakeholders:

1. Tax Identification Number (TIN)

- Requirement: Enrollment requires valid Tax Identification Number (TIN).

- Purpose: Zelis uses this to make sure it is reporting accurately for tax and compliance purposes.

2. National Provider Identifier (NPI)

- Requirement: Valid National Provider Identifier require from healthcare providers.

- Purpose: The NPI uniquely identifies providers so the payments go to the correct location in secure manner. Especially for medical professionals, clinics and hospitals.

3. Bank Account Information (for ACH Payments)

- Requirement: Providers that choose direct deposit (ACH) payments require accurate bank account details.

- Purpose: To allow for fast, secure and error free electronic fund transfers.

4. Affiliation with Healthcare Networks

- Requirement: It can only be run by providers and payers that are affiliated with a known healthcare agency, insurance company or a billing company.

- Purpose: It does so by limiting participation to legitimate stakeholders, which prevents the network from using its credibility poorly and makes it susceptible to fraudulent activity.

5. Verification of Identity and Compliance

- Requirement: We need vendors and payers to undergo an identity verification process to ensure their identity and compliance with industry regulations like HIPAA and PCI DSS.

- Purpose: This safeguards sensitive data and ensures the following industry security requirements are met:

6. Payment Preferences Setup

- Requirement: Enrollees must select their preferred payment method (ACH, Virtual Credit Card, or Paper Check) and provide necessary supporting documents.

- Purpose: This step customizes the payment, depending on users’ preference regarding the time of reimbursement.

7. Billing or Revenue Cycle Management Service Providers

- Requirement: The billing on behalf of providers in the managed care environment must enroll their networks of payers and prove their authority over their operations.

- Purpose: This allows third-party administrators (TPAs) to securely administer claims and process payments for their clients.

8. Compliance with Zelis Terms & Conditions

- Requirement: Each participant has to accept the terms of service of Zelis among which found data handling, privacy and security sections.

- Purpose: It allows for clear and collegial identification of the task and risks that may impact the project and its stakeholders.

This way, establishing clear and objective criteria for determining eligibility for enrolling in Zelis Payments guarantees a trouble-free and guaranteed identity for the enrolling entity. By implementing high and strict standards for its payment network, Zelis is securing its reputation and providing healthcare providers and payers with an exceptionally efficient tool for managing reimbursements while keeping all the claims genuine.

Common Mistakes to Avoid During Zelis Payments Enrollment

Enrolling in Zelis Payments is a straightforward process but certain mistakes delay or complicate the experience. Avoiding these common mistakes ensures smooth and efficient enrollment process.

1. Providing Incomplete or Incorrect Information

- Mistake: Submitting inaccurate or incomplete details like incorrect Tax Identification Number, National Provider Identifier or bank account information.

- Solution: Double check the entered information before submitting to prevent delays or rejections during the verification process.

2. Ignoring Required Documentation

- Mistake: Failing to upload necessary documents like tax forms, proof of identity, or banking details.

- Solution: Refer to the Zelis Enrollment Portal checklist to ensure all required documents are included during submission.

3. Delaying the Verification Process

- Mistake: Not responding promptly to requests for additional information or verification updates.

- Solution: Monitor your email and Zelis portal notifications regularly to address any follow-up requests quickly.

4. Choosing the Wrong Payment Method

- Mistake: Selecting non suitable payment method without understanding its implications like opting for paper checks when faster electronic methods are available.

- Solution: Evaluate payment methods ACH, virtual credit card or paper check and choose the best for your organization’s needs.

5. Neglecting Security Best Practices

- Mistake: Using weak passwords or sharing login credentials is risking security breaches.

- Solution: Implement strong password policies and enable multi factor authentication to protect sensitive information.

6. Overlooking Terms & Conditions

- Mistake: Skipping over the terms of service without fully understanding the platform’s requirements and policies.

- Solution: Carefully review Zelis’ terms to ensure compliance and avoid potential future issues related to data handling or payment processing.

7. Failing to Engage Support Resources

- Mistake: To troubleshoot issues independently without seeking help leads to prolonged problems.

- Solution: For guidance during the enrollment process, utilise Zelis support channels. Including the help centre and email support.

Enrollment Benefits

How Zelis Payments Streamlines Payment Processes and Improves Efficiency

Enrolling in Zelis Payments offers numerous advantages. It enhances the efficiency and security of healthcare reimbursements. Transforming how providers and payers manage their financial transactions.

- Faster Reimbursements

Enrollment eliminates the delays associated with traditional paper checks by offering electronic payment options like ACH and virtual credit cards. It enables providers to receive funds more quickly and reliably.

- Reduced Administrative Burden

By centralising payment management on single platform Zelis Payments reduces the need for manual paperwork and data entry. The automation significantly decreases administrative overhead and allows healthcare providers to focus more on patient care.

- Enhanced Cash Flow Management

Quick payment processing helps providers to better manage their cash flow and secure timely access to funds. The streamlined process accelerates claim approvals and payments. It reduces financial stress and enhances operational stability.

- Improved Security and Compliance

Zelis Payments includes features such as high-level encryption and the adoption of protocols such as HIPAA and some of the PCI DSS. If the payment details of a customer are processing cofully, it eliminatsh the probability of fraudsters or hackers accessing to the data.

- Simplified Record Keeping

The centralised platform provides user friendly dashboard for tracking payment history, claim status and notifications in real time. The organized approach simplifies auditing and reconciliation. It makes financial management more transparent and efficient.

- Flexible Payment Options

Zelis offers various payment methods including direct deposit, virtual credit cards, and paper checks. It caters to diverse preferences and ensures convenience for all stakeholders.

- Cost Savings

By reducing the reliance on paper-based processes, Zelis Payments helps lower administrative costs like postage, printing, and manual labour, contributing to overall operational savings.

- Better Communication and Support

Enrolled participants gain access to dedicated customer support channels, ensuring real-time assistance for any issues. This proactive support improves the user experience and swiftly resolves potential payment concerns.

Enrolling in Zelis Payments streamlines the healthcare payment process. It enhances effectiveness in both the external and internal operations, security and cash flow, and also eliminate most of the bureaucracy. Integrated with the centralized platform, both healthcare providers and payers achieve better financial management and shifted their core strategy to uplift the quality of service deliveries.

Frequently Asked Questions Related to Enrollment

1. What is Zelis Payments Enrollment?

Zelis Payments enrollment is the process for healthcare providers, payers and other stakeholders to join the Zelis payment network to transition from traditional paper based payments in streamlined digital payment system. The enrollment enhances payment efficiency, security and overall operational management.

2. Who Can Enroll in Zelis Payments?

Zelis Payments accommodates broad range of stakeholders includes:

- Healthcare Providers: Hospitals, clinics and laboratories.

- Payers: Insurance providers and other partners namely third party administrators.

- Billing & RCM Companies: Companies operating within the fields of medical billing or RH (revenue cycle management) for healthcare companies

3. What are the Eligibility Requirements for Enrollment?

To enroll you must participants must:

- Provide a Tax Identification Number and National Provider Identifier.

- Submit bank account details for ACH payments.

- Be affiliated with recognised healthcare networks.

- Agree with Zeli’s terms and conditions to ensure compliance with HIPAA and PCI DSS standards.

4. Which Payment Methods Are Offered by Zelis?

Zelis provides multiple payment options to suit different operational needs:

- Direct Deposit (ACH): Fast, secure electronic transfers.

- Virtual Credit Card: Immediate access to funds.

- Paper Checks: Traditional option for the hesitant to adopt digital payments.

5. How Long Is Enrollment Going to Take?

The timeline varies depending on the quality of the information being sought or sought after.

- Initial Registration: A few minutes.

- Verification: Typically within a few business days, contingent upon the correctness of submitted documents.

Prompt responses to follow-up requests can expedite the process.

6. What I Do If My Enrollment Is Delayed?

Common causes of delays include incomplete and inaccurate information. To avoid:

- Double-check your TIN, NPI and bank details.

- Respond promptly to any verification emails.

- Utilise Zelis support channels for immediate assistance.

7. Is My Information During Enrollment Is Secure?

Subsequently, the Zelis utilizes enhanced levels of encryption and connects with commodities such as HIPAA and PCI DSS. It safeguard data and reduce the chance of invasion from the unauthorized persons.

8. Can I Change Payment Preferences After Enrollment?

Yes, once your account is activated:

- Log into your Zelis Payments dashboard.

- Navigate to the Settings section.

- Adjust your payment preferences (ACH, virtual credit card, or paper checks) at any time.

9. What Support Options Are Available During Enrollment?

Zelis offers several support channels:

- Customer Support Hotline: Immediate, real-time assistance.

- Email Support: For detailed, non-urgent inquiries.

- Help Center: Access to FAQs, tutorials, and user guides.

- Dedicated Account Representatives: Personalized guidance for large healthcare providers or payers.

10. What Are the Benefits of Enrolling in Zelis Payments?

Key benefits include:

- Faster reimbursements through electronic payments.

- Reduce administrative burden via centralized payment management.

- Improved cash flow due to quicker payment cycles.

- Enhanced security with encryption and compliance protocols.

- Elastic payment options tailored to organizational needs.

See Also: Claims Process in Zelis Payments

Enrolling involves a straightforward process, beginning with an invitation from Zelis, followed by online registration where providers submit essential details like Tax Identification Numbers (TIN) and bank account information. Once verified, participants gain access to a secure system. It encrypts data and simplifies record-keeping by centralized dashboard. By enrolling stakeholders, we cannot only benefit from faster payments and reduce administrative costs. It enhances security and compliance, positioning itself at the forefront of modern healthcare payment solutions.